All Categories

Featured

Table of Contents

- – Fast Pre-approval Near Me (Salter Point WA)

- – Professional Property Financing – Salter Poin...

- – Dedicated Fixed-rate Mortgage (Salter Point WA)

- – Fast Home Buying Process Near Me – [:uarea] ...

- – Expert Credit Score For Mortgage Near Me

- – Cost-Effective Mortgage Insurance Near Me – ...

- – Dedicated Variable-rate Mortgage (Salter Point)

We aren't just talking regarding commemorating Consistency week every year; the differing experiences, perspectives, skills and histories of our home loan brokers permits us to: Have a much better interpersonal partnership, far better links with and understanding of the requirements of consumers. For one, it makes us discreetly mindful of the different cultural subtleties.

Besides, what we have actually seen is that generally, it's the older generation that chooses to talk with someone who talks their language, although they might have remained in the nation for a long period of time. It might be a social point or a language obstacle. And we comprehend that! Regardless, every Australian demands to be 100% clear when making one of the largest decisions in their life that is purchasing their initial home/property.

Fast Pre-approval Near Me (Salter Point WA)

For us, it's not just regarding the home financing. Above all, the home mortgage is a means to an end, so we ensure that the mortgage is suited to your details demands and goals. In order to do this, we understand and keep ourselves upgraded on the borrowing policies of almost 40 loan providers and the plan exceptions that can get an application approved.

, and various other areas where great consumers are let down by the financial institutions.

Professional Property Financing – Salter Point WA

We respond to some of one of the most frequently asked questions concerning accessing home mortgage brokers in Perth. The duty of Perth mortgage brokers is to give home mortgage financing remedies for their clients, utilising their local market knowledge and experience. Perth home loan brokers, such as our group at Lendstreet, pride themselves on discovering the very best mortgage borrowing option for your Perth building acquisition while guiding you via the whole process.

There are a great deal of mortgage brokers in Perth. Here are 10 great factors to consider me most importantly the others. All missed out on telephone calls will certainly be returned within 4 company hours All e-mails obtained prior to 5pm will certainly be responded to in the very same day Authorised credit history representative (CRN: 480368) of AFG (ACL: 389087) Participant of the Home Loan & Finance Organization of Australia (577975) Member of the Australian Financial Complaints Authority or AFCA (52529) BSc Business Economics from the London Institution of Economics Diploma of Financing and Mortgage Broking Administration Certificate IV in Finance and Home Mortgage Broking Component of a WA had and operated organization whose focus is entirely on the Perth market.

All solutions come at no expense to you and there are no Clawback charges. Offered to meet you from 7 am to 7 pm weekdays and offered on weekends. Over 1400 items, from even more than 30 lending institutions to select from. Our connection does not finish with the settlement of your car loan.

Dedicated Fixed-rate Mortgage (Salter Point WA)

All info provided is held in the most strict confidence and is taken care of in accordance with the 1988 Personal privacy Act.

In our experience as licenced mortgage brokers, we can take the burn out of home loan comparison. We contrast products from over 30+ lenders from the huge financial institutions to the little lending institutions. We utilise just the very best and simple contrasting tools to determine the very best owner occupied or financial investment loan for you.

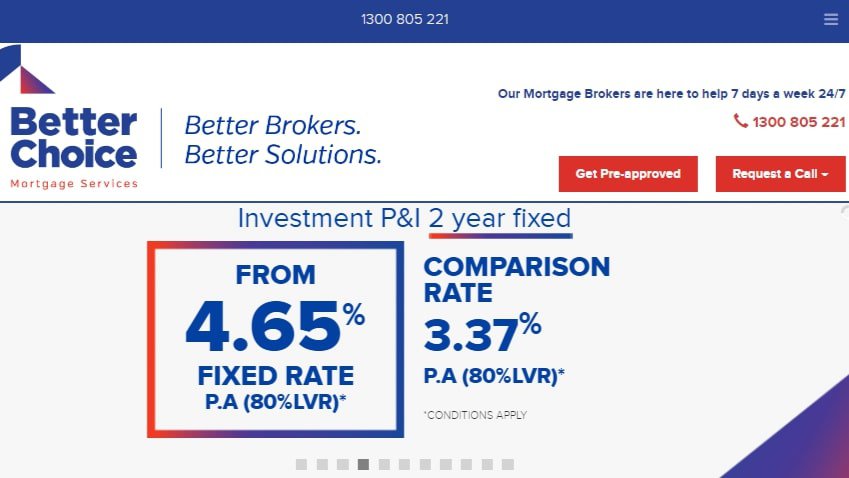

This isn't always the case. Reduced rate of interest can come with added costs or lending institution restrictions. This in truth can make the finance product more expensive in the long-term. Most financial institutions will sway consumers by showing just the advertised interest rate without considering elements that add onto your loan payments.

Fast Home Buying Process Near Me – [:uarea] 6152 WA

With a lot details out there, locating the very best home loan prices that ideal fit your monetary scenario can be a challenging task. It's our task to supply you with full item comparisons, including all the covert costs and charges to make sure that you compare any kind of home mortgage item as precisely as feasible.

Our home loan brokers have a collective 20+ years experience in the industry, are fully knowledgeable about the patterns for the Perth market making us experts for the job. By providing a contrast device that can help you in making a better financial decision, we're equipping consumers and educating them in the process.

Expert Credit Score For Mortgage Near Me

All you require to do is give us a telephone call..

I work as the liaison between you and the lending institution, making sure a smooth and reliable process, and saving you the tension. With nearly two decades in the home mortgage sector, I supply in-depth advice on all facets of mortgage financing. Whether you're considering the benefits of a fixed-rate vs. an adjustable-rate mortgage or concerned regarding financing functions and penalties, I'm here to offer clearness and guidance.

My extensive experience and partnerships within the industry permit me to secure much better rates of interest and perhaps also obtain specific charges forgoed for you. To summarize the above, the advantages of utilizing the services of a home mortgage broker such as myself consist of: My connections can open doors to loan options you may not locate on your own, tailored to your special situation.

Cost-Effective Mortgage Insurance Near Me – Perth

When you pick an ideal lending at an early stage, you'll hardly ever need to stress over whether you can still manage it when prices raise and you'll have a simpler time managing your monthly payments. Choice is the most significant advantage that a home mortgage broker can offer you with (debt-to-income ratio). The reason is that they have partnerships with a vast array of lending institutions that consist of financial institutions, constructing societies, and cooperative credit union

In general, the earlier you deal with a home loan broker, the far better. That's because functioning with one will certainly allow you to do even more in less time and get accessibility to better bargains you probably won't find on your own. Obviously you also have to be careful with the mortgage broker that you select to use.

In addition to that, ensure that they are accredited - refinancing. It may also be valuable to obtain recommendations from individuals you trust fund on brokers they have actually made use of in the past

A mortgage broker is a monetary specialist who specialises in home and financial investment lending funding. They link debtors with possible lenders and assist assist in the entire procedure. When you get in touch with a qualified economic broker for a home mortgage or financial investment financing requirement, they will certainly rest with you to recognize your certain financial demands and borrowing capability and help you safeguard an ideal lending at a market leading rate of interest.

Dedicated Variable-rate Mortgage (Salter Point)

We don't count on offering an one-time service yet goal to support a trusted partnership that you can rely upon over and over again. We comprehend that every customer has distinct requirements, as a result, we strive to use bespoke home mortgage services that ideal align with your choices each time. With an outstanding track document of pleased clients and hundreds of continual favorable Google assesses as social evidence, we are the leading team you need to depend on for searching for and protecting your following mortgage approval in Perth.

Table of Contents

- – Fast Pre-approval Near Me (Salter Point WA)

- – Professional Property Financing – Salter Poin...

- – Dedicated Fixed-rate Mortgage (Salter Point WA)

- – Fast Home Buying Process Near Me – [:uarea] ...

- – Expert Credit Score For Mortgage Near Me

- – Cost-Effective Mortgage Insurance Near Me – ...

- – Dedicated Variable-rate Mortgage (Salter Point)

Latest Posts

Transparent Mortgage Calculator Near Me

Transparent Government-backed Mortgage Near Me – Cannington WA

Affordable Rates Mortgage Products – Dalkeith WA

More

Latest Posts

Transparent Mortgage Calculator Near Me

Transparent Government-backed Mortgage Near Me – Cannington WA

Affordable Rates Mortgage Products – Dalkeith WA